- 0

Loans Originated

- 0

Loan Limit

- 0

Transactions Funded

A Partner You Can Rely On

Trust is the foundation of everything we do.

Your Trusted Partner

Trust is the cornerstone of our values with clients. At Lending Bee Inc., we prioritize transparency, integrity, and personalized service. We understand the importance of trust, especially in financial dealings.

About Us

Our comprehensive real estate finance knowledge and 20+ years of industry experience have helped us build a rock-solid reputation with hundreds of contacts and clients in our community.

Learn More

What Sets Us Apart

Lending Bee, Inc. distinguishes itself from other hard money lenders through our unwavering dedication to client relationships and willingness to tailor solutions to fit unique situations.

Build Your Financial FutureLeverage a Wide Range of Loan Programs

Every project is different, and client deserves individual attention—that's why we provide customized solutions.

-

Residential

California residential hard money loans are short-term, asset-based loans typically used by real estate investors to purchase, renovate, or refinance properties.

Read more -

Commercial

Commercial hard money loans are short-term loans backed by real estate and used for business purposes. Funded by private investors, they offer faster approval and flexible terms compared to bank loans.

Read more -

Fix and Flip

California residential hard money loans are short-term, asset-based loans typically used by real estate investors to purchase, renovate, or refinance properties.

Read more -

Bridge Loans: General Guidelines

California residential hard money loans are short-term, asset-based loans typically used by real estate investors to purchase, renovate, or refinance properties.

Read more

What Our Clients Are Saying

We do what traditional banks can't: make financing easy, quick, and enjoyable

Advantages of Hard Money Loans

Flexible, fast, and tailored financing solutions for ambitious real estate investors.

Minimal Documentation

The documentation required for hard money loans is far less demanding compared to traditional loans. Typically, investors only need to provide basic information about the property and their investment plan. This streamlined process reduces the administrative burden and allows investors to focus on what matters—their projects—instead of getting delayed by mountains of paperwork. This simply documentation process also speeds up loan approval and disbursement, so investors can move forward with their projects quickly.

Opportunity for Portfolio Expansion

Seasoned real estate investors can leverage hard money loans to rapidly expand their portfolios. With quick and reliable access to capital, these loans empower investors to take on multiple projects simultaneously, maximizing their potential for profit and enabling them to scale quickly—a huge advantage in the competitive real estate market. With hard money loans, California investors can pursue ambitious growth strategies and expand their reach and market influence while remaining financially agile.

Diversifying Investment Portfolios

Hard money loans not only expand investors' and brokers' portfolios—they help them effectively diversify. Traditional loans often limit how many properties an investor can finance at the same time, but hard money lenders in California focus on the collateral rather than an investor's debt load. This way, investors can spread their investments across multiple properties, reducing risk and increasing the likelihood of higher returns. A diversified portfolio can include a mix of residential, commercial, and rental properties, which improves an investor's overall financial growth and stability.

Facilitating High-Risk Investments

High-risk investments, such as distressed properties or developments in emerging markets, are more sensible with hard money loans. Traditional lenders often shy away from these ventures due to perceived risks, but hard money lenders are more willing to take them on. And although hard money loans tend to have higher interest rates, these are often offset by the potential for large returns. This willingness to finance riskier projects gives investors the power to explore opportunities that might otherwise be out of reach.

Strategic Application of Hard Money Loans

Adaptable solutions that empower investors to seize opportunities and drive growth.

Building Long-Term Relationships with Lenders

Hard money loans allow investors to build long-term relationships with lenders. Unlike the depersonalized processes of traditional banks, hard money lenders work closely with investors to clearly understand their goals and strategies. Over time, this level of communication leads to increased trust, translating to better terms and faster approvals. A strong relationship with a hard money lender is a valuable asset that opens up consistent, reliable funding for ongoing and future projects.

Customizable Loan Terms

Hard money loans have customizable terms so investors can tailor them to their specific needs. Whether it's the loan amount, repayment period, or interest rates, hard money lenders can flexibly align loans with an investor's strategy. This level of customization works wonders for real estate investors who juggle multiple projects that each require unique financing. Being able to directly negotiate terms with lenders allows for personalized financing that aligns with every goal and project timeline.

Supercharging Real Estate Strategies

Hard money loans supercharge your real estate and investment strategy. By leveraging their unique benefits and features, investors can create and execute plans that aren't doable with traditional financing solutions. Fix-and-flip projects, for instance, often rely on quick capital to purchase, renovate, and sell properties on tight timelines. Hard money loans are ideal for fix-and-flips because they can be approved very quickly and provide flexible terms. This helps investors secure properties in as little as 24 hours, helping them make key improvements and flip properties for a profit without exceeding their loan's short-term period.

Bridging the Gap Between Projects

Investors are constantly transitioning from one project to the next, so they need something reliable to get them through those gaps. Hard money loans are the bridge that carries them across. When an investor's waiting for a sale to close or for traditional financing to come through, hard money loans can step in and offer the necessary funds to keep new projects moving forward. This bridge-building ability lets investors take advantage of every opportunity that comes their way, even if temporary cash flows issues arise. Hard money loans are key to maintaining forward momentum, so investors can continue to fund and develop without any interruptions.

Adapting to Market Changes

Every investor knows how quickly the real estate market evolves, whether its due to economic shifts, regulatory changes, or emerging trends. Hard money loans provide adaptability in any situation, allowing investors to pivot at a moment's notice, no matter the situation. Whether it's capitalizing on a sudden market downturn, buying undervalued properties at lightning speed, or adjusting to new regulations, hard money loans create unparalleled flexibility for any investor. Leverage our loans to keep capitalizing on new opportunities and avoid the constraints of slower, more rigid traditional financing processes.

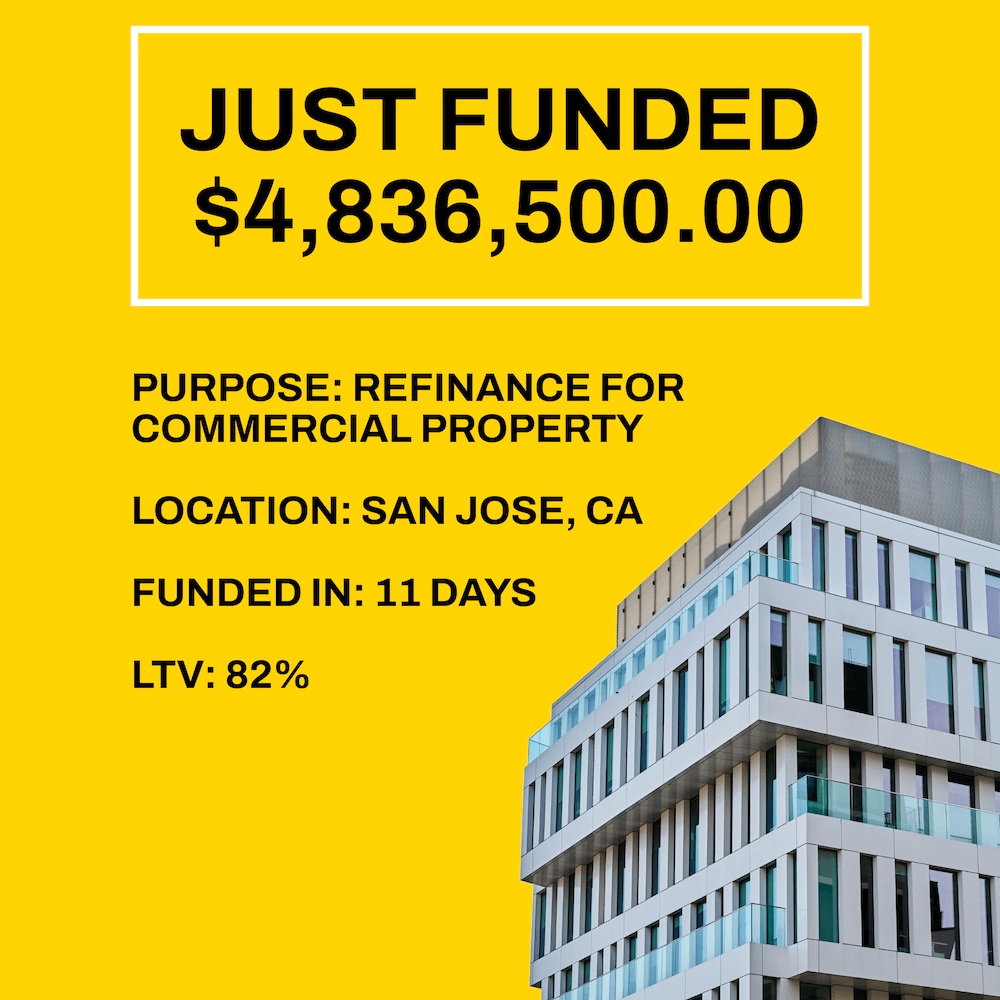

Latest funded deals

Move to PortfolioGet a free consultation

Fill out a simple form, and we'll get in touch to provide you with personalized loan program assistance.

Contact UsFAQ

-

A hard money loan is a loan that is secured by real estate, uses private funds, and often has a shorter term and a higher interest rate than a traditional loan. At Lending Bee we manage our own fund with a pool of investors which allows us to make the decision fast and provide you the funding within days.

-

Hard money loans are commonly used to finance investment properties such as fix-and-flips, rental homes, or commercial buildings. Single-family residences, multi-family properties, office buildings, retail spaces, hotels and industrial assets are all eligible.

-

The opportunity to obtain capital fast, the freedom to utilize the loan for a range of property kinds and uses, the possibility for better returns on investment properties, raising equity and increasing the liquidity are some of the advantages of using a hard money loan. It can be used with low credit score or bad credit history, no financial docs or income requirements, delapitated properties, delinquent payments and junior liens (subordinate financing), fix & flip, and construction.

-

The amount you may borrow with a hard money loan is determined by the value of the collateral property. Lenders will typically lend up to 70% of the value of the property, while certain lenders may give greater or lower loan-to-value ratios based on the the value and type of the property and borrower's creditworthiness.

-

Hard money loans are usually for six to 24 months, however certain lenders may provide longer terms up to 36 months. Interest rates can range from 8% to 15% or higher, and a balloon payment may be required at the conclusion of the period.